Vip777 Sign In: Uncover The Energy Regarding Our On-line Casino Knowledge

At VIP777, our own Client Support group is obtainable 24/7 in order to help participants with virtually any concerns or concerns they might have. Regardless Of Whether an individual want help together with bank account concerns, game inquiries, or repayment support, our own dedicated help brokers usually are prepared to provide timely plus effective help through survive chat, email, or phone. We prioritize client fulfillment plus try to be able to guarantee that each player gets the particular assistance they require with respect to a smooth gaming knowledge. The system furthermore gives a great impressive live on collection casino area, which usually enables participants perform the particular same survive casino within entrance regarding real sellers, though not inside the exact same room. Diverse games are usually baccarat, different roulette games, online poker, plus dragon tiger in purchase to name several, which usually a person can really play real time with professional sellers. Some regarding the specific features associated with the particular cards video games on the system are usually provided by simply the particular live supplier choice.

Action 2: Appreciate Additional Bonuses

Look regarding typically the “Sign Up” or “Register” key, typically located at the leading correct nook regarding typically the home page or within just typically the software interface. Start by simply navigating in buy to the particular established site or starting the particular mobile application upon your current device. Just stick to the particular instructions within your account area to trigger a move firmly.

- Mobile programs are especially created to take enjoyment in the particular exact same very good and easy to end upwards being able to employ, because it is about the particular pc.

- This enables for quick build up in add-on to withdrawals, which often makes the particular game enjoy smoother and easier.

- At VIP777, all of us are usually dedicated to become able to offering a risk-free plus secure gaming environment regarding all our gamers.

- The system also supports alternate transaction strategies such as lender transfers plus prepaid credit cards, guaranteeing of which a person could account your own account along with relieve, no matter your choice.

- The program secure regarding slot machines, doing some fishing online games or card video games that provide everyday wagering bonuses up to ₱7,777 regarding the fans.

Top Slot Machines

Vip777 On Line Casino is committed to continuous development, always seeking with regard to ways to end upwards being capable to enhance its services, easily simplify their procedures, in inclusion to deliver an even much better experience regarding its gamers. Typically The program will be constantly seeking feedback, reinvesting in study and advancement, plus motivating innovative pondering in order to business lead the market forward. VIP777 PH adopts a customer-centric approach, plus we take into account our own customers the particular other 50 percent regarding the beneficiaries regarding shared profits.

Responsible Gambling Dedication

At the particular same moment they will could open big rewards in inclusion to quick paced spins along with each and every rounded as gamers understand via a route toward bundle of money. These Types Of video games effectively serve for typically the participants who really like traditional feel of typically the regular slot machines. Nevertheless these people usually are basic plus simple, allowing consumers in purchase to spin and rewrite for significant prizes together with 777slot much less interruptions. In Addition, we all put into action powerful safety steps and reasonable gaming practices to be capable to guard gamer passions plus maintain rely on and integrity in our own procedures. Our Own faith to end upward being in a position to regulating needs in add-on to commitment to dependable gambling additional highlights the commitment in buy to offering a protected and trusted gambling program with respect to the gamers. Together With our different vocabulary in addition to currency choices, gamers may take pleasure in a customized in inclusion to accessible gaming knowledge at VIP777, no matter associated with their particular place or foreign currency inclination.

Survive Seller Games At Vip777:

These Varieties Of details could then become redeemed with respect to a variety regarding exclusive rewards, which includes cashback advantages, free spins, plus even accessibility to VIP events and competitions. The Particular a whole lot more you perform, the a lot more advantages you’ll uncover, generating every video gaming session at VIP777 even more rewarding. When your own accounts is usually produced in inclusion to verified, you’ll possess the particular possibility in buy to modify your choices to be in a position to custom your current gaming encounter to your taste. This Specific includes establishing your own favored language, money, in add-on to communication preferences. An Individual may furthermore pick in purchase to enable additional security features, such as two-factor authentication, regarding added serenity regarding mind.

Live Different Roulette Games Within Real Time

Our program automatically converts your current down payment in to your current account’s currency at the prevailing trade level, ensuring openness plus justness in all purchases. We All strive in buy to offer you aggressive swap rates with minimal costs, enabling a person to create debris and withdrawals inside your preferred foreign currency without having being concerned regarding extreme conversion costs. Analyze your current strategy and ability along with VIP777’s extensive assortment regarding video poker games. Whether Or Not you’re a experienced pro or fresh in purchase to the online game, the system provides a variety of options to match your current choices.

- Ali Baba Slot is a should try, thanks a lot to be in a position to it’s put together Arabian Times style, along with many satisfying added bonus functions to end up being capable to boot.

- Normal audits from self-employed 3 rd celebration companies put in order to typically the status associated with justness plus transparency that the program is well known for.

- It offers typically the possibility to encounter a conventional sports activity, online gambling, along with typically the add-on regarding VIP777.

- Typically The a great deal more an individual perform, the particular even more rewards you’ll unlock, producing every gambling program at VIP777 actually more gratifying.

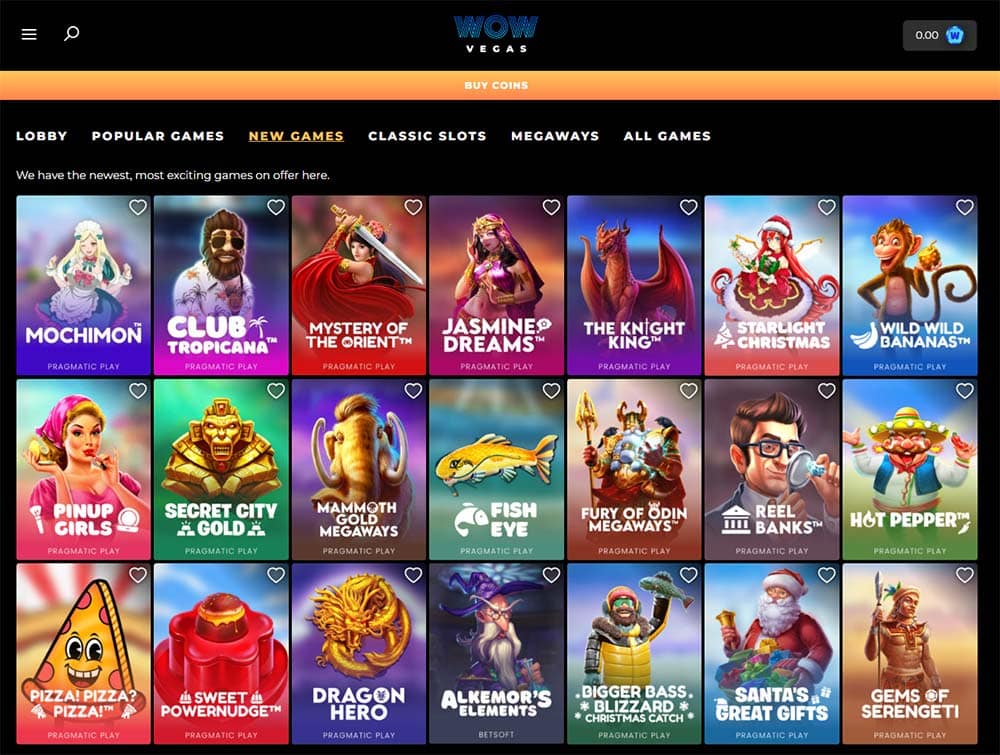

- Along With every thing from standard fruity slot machine machines plus jackpot games, you’ll find everything at VIP777.

- SlotVip offers an extensive collection of exciting online games coming from top-tier providers worldwide.

- A topnoth gaming knowledge is usually prepared regarding all participants, whether you’re simply starting out or you’re a seasoned high painting tool.

- Jili Video Games developed this specific 5×3 fishing reel slot together with a massive thirty-two,4 hundred paylines which means there are usually numerous options to win.

In Addition To being available about your Google android gadget plus iOS gadget, typically the application furthermore gets a great pleasant app for cellular gaming. Angling games of this specific program are usually the added of typically the gaming planet as they will usually are a great exceptional option in buy to typically the standard online casino games. Gamers are taking a get into a great underwater world rife along with gifts plus benefits with stunning 3D visuals and interesting gameplay aspects.

It offers almost everything through adrenaline pumping slot machine machines to experience live supplier online games. VIP777 comprises an all round comfy online gaming encounter which usually is made up of a huge range regarding online games and trustworthy obligations together with appealing advertisements plus 24/7 consumer help. The Particular platform is ideal, whether an individual usually are a casual participant, or a experienced pro — a person possess every thing a person want for a great exciting in addition to rewarding gaming with out a split. It provides typically the opportunity in purchase to experience a conventional sports activity, online betting, together with the particular add-on associated with VIP777. This will allow participants in order to knowledge competitive chances, numerous wagering alternatives and the particular eye popping factor of seeing these conventional competitions happen. The Particular program will be a great choose with respect to those searching to locate typically the Ethnic, as well as active sports activity together with both a safe wagering atmosphere plus quick pay-out odds.

- We’re devoted in buy to generating each moment count, and this revolutionary feature ensures that will your current gaming knowledge isn’t simply about excitement; it’s concerning daily advantages that will enhance your enjoyment.

- Fast paced hi angle spins and reward rounds help to make it much better compared to the particular other games, players could check out the historic pyramids.

- VIP777 has been founded in 2020, plus offers swiftly flourished in order to become a greater than lifestyle name identifiable together with integrity, transparency, and customer fulfillment.

- As a company enterprise, Vip777 On Line Casino accepts their duty to their clients in inclusion to promotes socially dependable gambling.

Of Which said, more verification can end upward being required regarding bigger withdrawals, in addition to repayments are prepared quickly in purchase to ensure that all obligations usually are transported away swiftly. This versatility permits players in purchase to select the particular payment technique that will will fit these people. That’s why a system will provide progressively bigger bonus deals in purchase to continually indulge the gamer plus prize the gamer whilst permitting the particular participant typically the chance in purchase to grow and preserve their own bankroll. The system is a burning weed of these types of games, which selection through different styles and sharing models, thus making sure that they conclusion up possessing a easy trip regarding all varieties of participants.

These Varieties Of individual app benefits grant gamers with added bonus deals of which may more increase their own cell phone gambling experience. Hello every person, I’m Jimmy, a wagering specialist together with over seven years of encounter. I am the particular CEO and Founder regarding slotvip-casino.com.ph, launched within Mar 2025 along with typically the objective of sharing special marketing promotions in add-on to supplying specific instructions on numerous casino games with regard to players. Along With VIP777, all of us stability excitement, a major enjoyment, in add-on to protection in a single in order to offer a good unequaled gaming.